- Eldershield

- Medishield Premium

- Medishield Life Copayment Login

- Medishield Life Scheme

- Medishield Life Singapore

By Linette Lai

Under MediShield Life, the co-insurance rate starts at 10% and goes lower as the claimable amount increases. D = The portion covered by MediShield Life - MediShield Life benefits are designed to cover subsidised bills incurred by Singapore Citizens at Class B2/C wards and subsidised outpatient treatments/day surgery at public hospitals. You may also use your MediSave to help pay for outpatient treatments for your dependents. The limit here is $500 per year per MediSave account, and a co-payment of 15% applies. Difference #6: MediSave may not be used for related expenses.

MediShield Life’s basic health insurance protection is very bare-bones. Payouts will only cover stays in Class B2 or Class C wards in public/restructured hospitals, and a lot of things are not. If You Have an Existing IP With Full Rider, Nothing Has Changed for You. We have observed some.

MediShield Life, which replaces MediShield, will take effect on November 1, 2015. The compulsory all-inclusive health insurance scheme provides lifetime coverage for all Singaporeans and permanent residents, regardless of age or pre-existing health conditions. Reporter Linette Lai, with help from the Ministry of Health, puts together a comprehensive guide to the new scheme. Here are the answers to 101 frequently asked questions.

The Basics

4. What is the difference between MediShield and MediShield Life?

These are the key differences between the two:

5. What's the difference between MediShield Life and Medisave?

6. Can I choose to not be covered by MediShield Life?

7. What do I have to do to get MediShield Life coverage? Do I have to register somewhere?

8. What are the premiums for MediShield Life like?

10. Can I use MediShield Life in both public and private hospitals?

They range from $1,500 to $3,000, depending on your age and class of hospital ward you choose.Here's an example:

If your hospital bill is $1,400, you will not be able to claim under MediShield Life if your deductible is $1,500.

However, you only need to pay the deductible once every policy year

So, if you are warded multiple times in a year and are charged $1,500 every time, you would be able to claim from MediShield Life after that first hospital stay.

Under MediShield Life, the co-insurance rate is between 3 and 10 per cent, depending on the size of your bill.

13. Can I buy riders to cover the deductible for MediShield Life?

But PRs won't get any 'transitional subsidies' - that is, the subsidies that Singaporeans get in the first four years of MediShield Life's implementation which will help them ease into the scheme. PRs will also get only half the permanent subsidies that Singaporeans get.

15. Are the family members of PRs who live in Singapore (but who aren’t PRs themselves) covered by MediShield Life?

Making Claims

16. What sort of treatment and medication does MediShield Life cover and what doesn’t it cover?

Generally, MediShield Life will cover more of big hospital bills - including both surgery and ward charges - than MediShield currently does.

For example, it will cover more of the cost of chemotherapy and radiotherapy. It also covers things like implants and kidney dialysis.17. I want to see what someone’s hospital bill might look like with MediShield Life.

You are a 60-year-old who was warded in a B2 ward for 10 days after a heart attack. Your bill is $8,100.

You will have to pay $2,000 in deductibles and a further $455 in co-insurance.

The total that you pay is $2,455.

The total that MediShield Life pays is $5,645.

Under MediShield, your co-insurance would be higher, at $605. Claim limits are also lower, so you would end up paying $4,655.

MediShield would pay $3,445.

18. How do I make claims? Is there a lot of paperwork involved?

19. I have to pay a lot in cash whenever I go to the hospital for scans and tests. Is it true MediShield Life doesn't cover these?

20. If payment for my premiums lapses - for example, if I am unemployed and have run out of funds in my Medisave - and I have to be hospitalised, will I still be covered by MediShield Life?

21. I would rather stay in a class B1 ward but MediShield Life covers only up to class B2. Why doesn't MediShield Life provide better coverage?

22. Can rich people still choose to go to a C class ward?

23. If a person deliberately injures himself and has to be hospitalised, can he claim under MediShield Life?

24. If I fall ill while holidaying or studying abroad and am hospitalised there, can I claim under MediShield Life?

25. I am a Singaporean married to a foreigner and live abroad, returning to Singapore only for holidays. Can I claim from MediShield should I be hospitalised in the country I’m now living in?

Pre-existing conditions

26. What is considered a pre-existing condition?

27. Do people with pre-existing conditions pay more premiums?

28. What are some examples of serious pre-existing conditions?

However, note that if this health condition developed after the start of your insurance cover with MediShield or an Integrated Shield Plan, you will not be considered to have a pre-existing condition.

Click here for details.

29. Why should those with pre-existing conditions pay more? What if they can't afford it?

Subsidies are also applicable to the additional 30 per cent premium to be applied for those with serious pre-existing conditions. This includes the Premium Subsidies for the lower- to middle-income, Pioneer Generation Subsidies and Transitional Subsidies. For the needy, on a case by case basis, the Government will provide Additional Premium Support.

31. How many people who are not insured under MediShield have pre-existing conditions?

Of those covered under MediShield or Integrated Plans but with exclusions on certain conditions, around 2,000 will have to pay higher premiums.

32. I have a pre-existing condition that is not covered by MediShield. Will how much extra I have to pay under MediShield Life depend on how serious this condition is?

33. I have a pre-existing condition. Do I have to declare it to the Government?

34. What if I had cancer as a child but am an adult now and completely cured of it. Am I considered as having a pre-existing condition and do I have to pay more premiums? What if I can produce a doctor’s letter to say I’m completely healthy now?

35. I was fully covered on a B1 class Integrated Plan. But when I upgraded it to an A Class plan, I was excluded for conditions I had recently acquired. Will I need to pay the 30 per cent loading for pre-existing conditions for MediShield Life?

37. How do I know if I have to pay higher premiums?

38. Will someone with a developmental disorder, like autism, have to pay higher premiums?

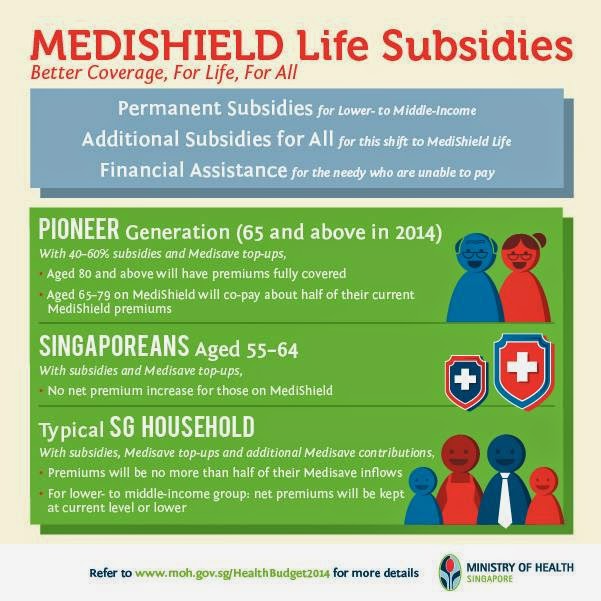

Subsidies

39. What kind of premium subsidies will I get under MediShield Life?

This is defined as households where the per capita monthly income is $2,600 or lower, and who live in properties whose annual value is $21,000 or less. The Health Ministry has said that this means two out of three people will get these permanent subsidies.

If you are a Singaporean, you will also get transitional subsidies spread over four years to help ease you into the scheme. You will get these regardless of your income or residence.

Those in the Pioneer Generation will also get special subsidies of between 40 to 60 per cent, depending on their age. This is on top of the other subsidies.

40. Isn’t the maximum income level of $2,600 per capita monthly to qualify for permanent subsidies rather low if two out of three people are to get them?

A working couple with two kids and an elderly parent, earning a total of $12,000 a month, would qualify, as their monthly income per person would be $2,400.

41. Why is annual value of residence used as a criteria for subsidies? What about “asset-rich, cash-poor” citizens?

Those with a home of a higher annual value would, generally speaking, be better off.For those who find it hard to afford premiums but do not qualify for subsidies due to their home’s annual value, additional help may be made available on a case-by-case basis, depending on a person’s family circumstances.

42. I live in a condominium and I have heard that those with houses above a certain annual value will not get subsidies. How can I find out the annual value of my property?

43. What happens if I own more than one property?

44. What if I move from a property of higher annual value to one that is lower? Do I get more subsidies and how do I inform the Government of my move?

45. What do I have to do to qualify for subsidies?

46. My son is paying for my premiums. Will I still get the subsidies?

Premiums

48. Where can I find out how much my premiums will cost?

49. What happens if I don't have enough money in my Medisave account?

50. Can I pay for my premiums in cash, rather than using Medisave?

51. I don't have enough money in my Medisave account to pay for my premiums. Will the Government take the money from my Ordinary or Special accounts in my CPF?

52. What if I forget to pay my premiums? Will I get reminders and will I be penalised?

However, if everyone in your age band makes many claims, premiums may go up the next time the Health Ministry reviews this group.

54. My mother doesn't have any money in her Medisave account. Can I pay for her?

55. Can I pay for other people’s premiums? Like my children’s, or siblings, or how about for friends?

56. I don't want the Government to deduct money from my Medisave account to pay for my parents' premiums. Can I stop this from happening?

57. My sister paid premiums consistently while she was working, but died suddenly in an accident. What happens to the money she paid?

In line with the principle of insurance, premiums are risk pooled and used to support payouts for policyholders who fall ill and make claims. While some members may die earlier, the contributed premiums will continue to support the rest of the pool. For those who die without making a claim, premiums that they had contributed in the past will have gone towards supporting the claims payouts and commitments for the Scheme.

If a member dies through the premium year, the premium will be pro-rated and refunded to the member’s Medisave account, according to the number of months left in the premium year. These Medisave monies will be distributed to the family members, along with other Medisave monies.

59. Premiums for MediShield went up quite substantially in 2013. MediShield Life premiums are going to be even more expensive than that. Why are they going up again so soon?

As MediShield Life provides better coverage, higher premiums are to be expected.

60. What happens if I miss many premium payments?

61. I was suddenly retrenched and I can't afford to pay my premiums for a while. Will I be penalised for this?

If you still leave or try to do so, you may be jailed up to a year, fined up to $5,000, or both.

63. What happens if I deliberately refuse to pay my premiums for months - if, for example, my Medisave account is empty and I don't top it up even though I have the money to?

64. What kind of penalty will I get if I am late in paying my premiums?

65. What if I am a single, unwed mother? Am I responsible for my child’s premiums?

66. Who will be in charge of recovering outstanding premiums?

67. What if I haven’t yet started working and have no Medisave? How am I going to pay my premiums?

Data Privacy

68. What kind of health and income records will the Government look at?

69. How is the Government able to check on my records? Is there some giant computer somewhere?

The Government will not be looking at private or commercial data, including bank accounts or credit records.

It will ensure that as many Singaporeans as possible are able to benefit from the subsidies. This is particularly important for the vulnerable and needy who may find it more challenging to put together the necessary forms and documents that are normally needed to access government subsidies.You may choose to deny the Government access to your information. However, you will not get any Premium Subsidies as there is insufficient information to assess your eligibility.

71. Why should I have to pay higher premiums just because I want to keep my medical data private?

72. I don't want the Government to access my medical records. What do I do?

If you do not want to pay higher premiums, you can choose to submit a statutory health declaration or other documentary proof of your health status.

73. I have decided that I don't mind giving the Government access to my income records after all. Can I opt back in?

74. How is the Government going to make sure that my private data is secure?

Those who violate this rule can be jailed up to a year, fine up to $5,000, or both.

75. How will the Government assess and extend MediShield Life Premium Subsidies to eligible Singaporeans?

Integrated Shield Plans

76. What is an Integrated Shield Plan and how are premiums for it paid?

77. How do I know if I have an Integrated Shield Plan?

78. Who can I buy an Integrated Shield Plan from?

79. If I have an Integrated Shield Plan and MediShield Life, does that mean I will be paying for two policies?

Eldershield

80. If I am hospitalised, can I claim separately from the Integrated Shield Plan and MediShield Life?

81. I bought a private Integrated Shield Plan many years ago, but as I age I find the premiums are getting higher. Should I cancel it?

82. Will I get MediShield Life premium subsidies if I'm on a private Integrated Shield Plan? Must I downgrade it to get subsidies?

83. I find all the Integrated Shield Plans available very confusing and cannot decide which to buy.

This will help people make more informed decisions about buying such plans.

85. I have read about MediShield Life, but I’m still not sure whether I should drop my Integrated Shield Plan.

86. I heard that the Government is setting up a standardised Class B1 Integrated Shield Plan. When will it be launched?

More Questions

88. How would I know what is covered and what is not?

The report can be found at www.moh.gov.sg/content/moh_web/MediShield-life/mlrc-report.html

89. Does MediShield Life cover cosmetic surgery like liposuction?

90. Why doesn't MediShield Life cover palliative care?

91. I am a Government pensioner and I get better medical benefits under my pension scheme. Can I opt out of MediShield Life?

To ensure that pensioners will not be worse off with the introduction of MediShield Life, the Government will help pensioners with their MediShield Life premiums. The Government has written directly to all affected pensioners.

92. People who stay healthy and don't make claims should be rewarded. Why isn't there a no-claim bonus?

93. MediShield Life is going to be heavily subsidised. Does this mean taxes will go up?

94. My employer already gives me health insurance coverage. Why do I need MediShield Life?

MediShield Life ensures that all Singaporeans will have assurance against large healthcare bills for life regardless of your employment status, e.g. in between jobs or after retirement.

95. Will MediShield Life cover my stay in a community hospital?

96. How is the Government making sure doctors don’t give me unneccessary treatments or medication now that there is MediShield Life?

When it comes to treatments, the Government is also urging doctors and patients to keep in mind cost-effectiveness, and that expensive does not always mean better.

97. How much is it going to cost to cover all Singaporeans and PRs under MediShield Life?

98. Is the average Singaporean going to bear the burden of covering all these additional people?

However, Singaporeans will co-share part of this cost as part of collective responsibility.

99. My daughter has lived overseas for 15 years and has no intention of coming back to Singapore even though she’s still a Singaporean.

Can she opt out of MediShield Life, and if not why not?

100. My son has lived overseas for a long time and has very little in his Medisave account. How is he going to pay his premiums?

Medishield Premium

101. If he doesn’t pay, will he be arrested when he enters Singapore?

When you fall sick, what’s the first thing you do? Complain about how expensive healthcare is in Singapore? Well, after doing that, the next thing you should do is to see how MediShield Life can help you.

But what the heck is MediShield Life anyway? How do you benefit from it? And why do you need it when part of your CPF contributions already have to go into your Medisave account? These questions and more will be answered right here.

Contents

- What on earth is MediShield Life?

- Who is eligible?

- What benefits do you get from MediShield Life?

- What are the exclusions?

- What is the deductible and how much must you pay?

- What is the co-insurance portion and how much must you pay?

- How do you make a MediShield Life claim?

- What happens if you have a pre-existing condition?

- How much are MediShield Life premiums?

- What subsidies will you get?

- Updates to MediShield Life

- What is an Integrated Shield Plan and how does it work with MediShield Life?

What on earth is MediShield Life?

Have you ever been told that you’ll go bankrupt if you fall seriously ill and don’t have medical insurance?

Well, guess what, even if you’ve never spoken to an insurance agent or purchased a single insurance policy in your life, you actually are covered by medical insurance, and that’s MediShield Life.

MediShield Life is a basic medical insurance plan which all Singaporeans and PRs are automatically enrolled in.

It works in the same way as other types of health insurance. Basically, you can make a claim for certain types of medical bills, including hospitalisation and certain types of outpatient treatment.

The catch is that, being a very basic plan, there are strict limits as to how much you can claim and what is covered.

For instance, if you get hospitalised, your MediShield Life payouts will only able to cover the cost of Class C or Class B2 wards at public hospitals.

To give you an idea of the difference in price, here are the median hospital bills from MOH for a knee joint replacement surgery at the various wards:

| Ward class | Total hospital bill |

| Public hospital — C | $5,329 |

| Public hospital — B2 | $6,432 |

| Public hospital — B1 | $19,772 |

| Public hospital — A | $22,389 |

| Private hospital | $34,531 |

For public hospitals alone, the moment you upgrade from Class B2/C to Class B1/A, prices more than triple. Big difference!

So if you want to stay in a higher class ward or go to a private hospital, MediShield Life won't be enough. You'll need to supplement your plan with an Integrated Shield plan (more on that below) for higher coverage, and/or top up the remainder in cash or Medisave.

Who is eligible for MediShield Life?

All Singapore citizens and PRs are automatically granted lifetime protection by MediShield Life.

If you are a PR, it’s important to note that the amount of subsidies you receive at public hospitals will be lower than what Singapore citizens receive. This is likely to result in your having to pay higher out-of-pocket charges.

You cannot opt out of MediShield Life, and have to continue paying the premiums over your lifetime — unless you live overseas and have no intention of returning. Then you can apply to opt out.

Medishield Life Copayment Login

You enjoy lifetime coverage regardless of any pre-existing medical conditions.

What are the MediShield Life exclusions?

There are certain things you can’t use MediShield Life to pay for, such as the following.

- Ambulance fees

- Cosmetic surgery

- Maternity charges (including Caesarean operations) or abortions, except treatments for serious complications related to pregnancy and childbirth.

- Dental work (except due to accidental injuries)

- Infertility, sub-fertility, assisted conception or any contraceptive operation

- Sex change operations

- Optional items which are outside the scope of treatment

- Overseas medical treatment

- Private nursing charges

- Purchase of kidney dialysis machines, iron-lung and other special appliances

- Treatment which has received reimbursement from Workmen’s Compensation and other forms of insurance coverage

- Treatment for drug addiction or alcoholism

- Treatment of injuries arising directly or indirectly from nuclear fallout, war and related risk

- Treatment of injuries arising from direct participation in civil commotion, riot or strike

- Expenses incurred after the 7th calendar day from being certified to be medically fit for discharge from inpatient treatment and assessed to have a feasible discharge option by a medical practitioner

- Treatment of self-inflicted injuries or injuries resulting from attempted suicide

- Vaccination

- Surgical interventions for the following rare congenital conditions which are severe and fatal by nature: Trisomy 13, Bilateral Renal Agenesis, Bart's Hydrops and Anecephaly

Here's the MOH page with an up-to-date list of exclusions.

What is the deductible and how much must you pay?

So, you might have read that there is a 'deductible' for MediShield Life. The deductible is the amount of money you have to pay before you can make your first MediShield Life claim each year, and it depends on which ward you stay in.

| Deductible in the policy year | ||

| Age 80 and under | Age 81 and over | |

| Class C | $1,500 | $2,000 |

| Class B2 and above | $2,000 | $3,000 |

| Day surgery | $1,500 | $3,000 |

You will only have to pay the deductible once a year, even if you make multiple claims in that year. Example:

You get hospitalised twice in a year, and in both cases you get warded in a Class B2 ward. Your first medical bill is $8,000 and the second is $4,000, making a total of $12,000.

Being under 81 years old, you would thus pay a deductible of $2,000 after your first hospital visit. As deductibles are only payable once a policy year, you would not have to pay any deductible when making a claim for your second visit.

What is the co-insurance portion and how much must you pay?

The deductible isn’t the only money you need to fork out in order to make a MediShield Life claim.

You will also have to pay co-insurance, which is calculated as a percentage of the amount you’re trying to claim. While the deductible is charged only once a policy year, co-insurance must be paid each time you make a claim.

The amount of co-insurance you must pay varies according to the size of your bill.

| Amount being claimed | Co-insurance |

| $0 to $3,000 | 10% |

| $3,001 to $5,000 | 10% |

| $5,001 to $10,000 | 5% |

| > $10,000 | 3% |

Example: Let’s take the example in the previous section, where you incurred two hospital bills worth $8,000 and $4,000 respectively, and paid a deductible of $2,000 after the first hospital visit.

After paying your deductible, you’ve still got $10,000 worth of expenses.

After the first hospital visit, which cost $8,000, you paid a deductible of $2,000. You would then submit a claim for $6,000. The co-insurance portion for that sum is 10% of the first $3,000 and 5% of the next $3000, so you would pay $450 and claim the remaining $5,550.

For the second hospital visit, there is no deductible, so you can submit a claim for the entire bill of $4,000. The co-insurance portion is 5% for the first $2,000 and 3% for the next $2,000 so you would pay co-insurance of $160, and then receive $3,840 worth of MediShield Life payouts.

In this scenario, your total medical bill of $12,000 is broken down as follows:

| MediShield Life payout | $9,390 |

| Deductible (paid by you) | $2,000 |

| Co-insurance (paid by you) | $610 |

| Total medical bills | $12,000 |

Medishield Life Scheme

As you can see, to cover your medical bills totalling $12,000, you would have to fork out $2,610, and the rest would be paid by MediShield.

How do you make a MediShield Life claim?

The claims process differs depending on whether you have purchased an Integrated Shield Plan (ie. a private health insurance policy that works in tandem with MediShield Life), or whether you will be relying solely on MediShield Life.

If you don’t have an Integrated Shield Plan

You’re probably wishing you had an Integrated Shield Plan right now. The good news, if we can call it that, is that the paperwork for your MediShield Life claim will be handled by the staff at your hospital or other healthcare provider.

Once you are admitted, inform the staff that you wish to make a MediShield Life claim to pay part of your bills. The medical institution will submit your claim on your behalf after receiving your authorisation.

The MediShield Life payouts will be computed based on the relevant benefits and claim limits, taking into account the deductible. You can then use your Medisave or cash to make the payment for the co-payment amount.

The MediShield Life payout will be released to the medical institutions by the CPF Board after the claim has been processed.

If you have an Integrated Shield Plan (IP)

Contact your insurer or agent immediately when you know you’re going to be admitted to hospital. Also inform hospital staff that you wish to pay your bill using your IP.

Medishield Life Singapore

MediShield Life is included in all IPs. IPs comprise of 2 components, where the MediShield Life components are run by CPF board and the additional private insurance coverage component is run by the insurance company.

Your insurer will process your claim and send payment to the hospital or other medical institution on your behalf. They will also handle the documentation for your MediShield Life claim, and the portion of your bill being paid by MediShield Life will automatically be sent to the medical institution.

Obviously, whether you have an IP or not, any sums on your bill that cannot be covered by MediShield Life or your IP will be dutifully billed to you.

What happens if you have a pre-existing condition?

Unlike most kinds of insurance, MediShield Life covers all pre-existing medical conditions. If you joined MediShield Life with one of the below pre-existing conditions (e.g. in the case of PRs) you will need to pay 30% additional premiums for 10 years.

| Broad categories | Examples |

| Cancer | Lung cancer, colorectal cancer, breast cancer, stomach cancer |

| Blood disorders | Aplastic anaemia, thalassemia major |

| Degenerative diseases | Parkinson’s disease, muscular dystrophy, amyotrophic lateral sclerosis (ALS) |

| Heart or other circulatory system diseases | Heart attack, coronary artery disease, chronic ischaemic heart disease |

| Cerebrovascular diseases | Stroke |

| Respiratory diseases | Chronic obstructive pulmonary disease |

| Liver diseases | Alcoholic liver disease, chronic hepatitis, fibrosis or cirrhosis of liver |

| Autoimmune / Immune System diseases | Systemic lupus erythematosus, HIV, AIDS |

| Renal diseases | Chronic renal disease, chronic renal failure, chronic nephritic syndrome |

| Serious congenital conditions | Congenital heart disease, congenital renal disease biliary atresia |

| Psychiatric conditions | Schizophrenia |

| Chronic conditions with serious complications | Hypertensive heart disease, hypertensive kidney disease, diabetes with kidney complications, diabetes with eye complications |

After 10 years, your premiums go back to normal. Additional premiums are Medisave-payable.

How much are MediShield Life premiums?

Of course, somebody’s got to pay for MediShield Life. You will have to pay MediShield Life premiums annually, and these premiums will rise as you age.

| Age on next birthday | Annual MediShield Life premium |

| 1-20 | $130 |

| 21-30 | $195 |

| 31-40 | $310 |

| 41-50 | $435 |

| 51-60 | $630 |

| 61-65 | $755 |

| 66-70 | $815 |

| 71-73 | $885 |

| 74-75 | $975 |

| 76-78 | $1,130 |

| 79-80 | $1,175 |

| 81-83 | $1,250 |

| 84-85 | $1,430 |

| 86-88 | $1,500 |

| 89-90 | $1,500 |

| >90 | $1,530 |

The good news is that you can pay 100% of your MediShield Life premiums using Medisave. Your premiums will be automatically deducted from your Medisave account if you have enough. Or, your immediate family members may pay your premium using their Medisave.

Can you get MediShield Life premium subsidies?

Yes, if you're in the lower income group. You can get discounted premiums ranging from 15% to 50%, depending on your income level. Here are the 2019 MediShield Life premiums after subsidy:

| Age on next birthday | Lower income | Lower-middle income | Upper-middle income | No subsidy |

| 1-20 | $98 | $104 | $111 | $130 |

| 21-30 | $146 | $156 | $166 | $195 |

| 31-40 | $233 | $248 | $264 | $310 |

| 41-50 | $305 | $326 | $348 | $435 |

| 51-60 | $441 | $473 | $504 | $630 |

| 61-65 | $491 | $529 | $566 | $755 |

| 66-70 | $530 | $571 | $611 | $815 |

| 71-73 | $575 | $620 | $664 | $885 |

| 74-75 | $634 | $683 | $731 | $975 |

| 76-78 | $678 | $735 | $791 | $1,130 |

| 79-80 | $705 | $764 | $823 | $1,175 |

| 81-83 | $750 | $813 | $875 | $1,250 |

| 84-85 | $858 | $930 | $1,001 | $1,430 |

| 86-88 | $825 | $900 | $975 | $1,500 |

| 89-90 | $825 | $900 | $975 | $1,500 |

| $90 | $765 | $842 | $918 | $1,530 |

To figure out which group you belong to,

- Lower income: Household monthly income of $1,200 or less per person.

- Lower-middle income: Household monthly income of $1,201 to $2,000 per person.

- Upper-middle income: Household monthly income of $2,001 to $2,800 per person.

In addition, to receive any subsidies at all, you must live in a residence with an annual value of $13,000 or less. If you live in a residence with an annual value of between $13,001 and $21,000, your subsidy rates will be cut by 10%.

Oh yes, and those who are part of the Pioneer Generation get 40% to 60% in MediShield Life premium subsidies from age 66 onwards. Meanwhile, the Merdeka Generation gets 5% premium subsidy from age 60 to 75, and 10% subsidy from age 76 onwards.

Updates to MediShield Life in 2021

Healthcare being a major government priority, MediShield Life does undergo a certain amount of scrutiny by the higher-ups, and does get tweaked from time to time to meet coverage gaps. But in 2021, there will be a major review of the MediShield Life scheme. Due to healthcare inflation, the current benefits are now lagging behind the actual cost of healthcare and need to be revised upwards. The proposed changes include:

- Revising the annual claim limit from $100,000 to $150,000

- Higher claim limits for the first 2 days of hospitalisation, which is when most diagnostics and tests happen

- Higher claim limits for intensive care, dialysis, and psychiatric care

- Higher coverage for sub-acute care at community hospitals

- Coverage for attempted suicide, self-harm, substance abuse and alcoholism

- More affordable day surgery for the elderly — so they do not need to be warded to claim

- Private hospital claims will be capped at 25% down from 35%

However, these enhancements would also mean up to 35% increase in MediShield Life premiums. Yikes.

What is an Integrated Shield Plan and how does it work with MediShield Life?

You’ve already heard that you can’t rely solely on MediShield Life because of how basic it is.

But the solution is pretty easy: Upgrade your coverage is to opt for an Integrated Shield Plan (IP), which can be paid for with Medisave. There are 7 insurers that provide IPs in Singapore.

Integrated Shield plans comprise the MediShield Life base plan + additional private insurance provided by the insurance company. So there's no duplicate here.

One of the biggest benefits to getting an IP is that you have the option of staying in private hospitals or upgrading to Class B1 and A wards and get covered. This also gives you the chance to choose your own doctor, with the possibility of shorter queues and wait times. You can also buy riders for your IP to receive even greater coverage.

The downside is obviously that you’ll be paying higher premiums if you have an IP, and there may be a cash portion that cannot be paid using Medisave. These premiums may be affordable when you’re young, but they’ll rise as you age and can eventually get quite hefty.

For more details, check out our Integrated Shield plan comparison.

The post CPF MediShield Life in Singapore - Everything You Need to Understand & Use It appeared first on the MoneySmart blog.